- 19-07-2023

- Admin

Navigating International Trade with Letter of Credit (LC): The Key to Smooth Transactions

When buyers and sellers engage in maritime trade operations on a global scale, various uncertainties can arise. These uncertainties often relate to delayed payments, slow deliveries, and financing-related challenges, among other issues. The vast distances involved in international trade, diverse legal frameworks, and evolving political landscapes contribute to the need for sellers to have a guarantee of payment when delivering goods through the maritime route to their buyers. To address these concerns, letters of credit were introduced as a solution, incorporating a third party such as a financial institution into the transaction to mitigate credit risks for exporters.

What is a Letter of Credit?

A letter of credit, also known as an LC, is a written instrument provided by the importer's bank (referred to as the opening bank) to secure the interests of the exporter. By issuing an LC, the importer's bank guarantees payment to the exporter for any international trade transactions carried out between the two parties.

In the context of a letter of credit (LC), the importer is known as the applicant, and the exporter is referred to as the beneficiary. The issuing bank, in an LC, commits to making payment for the specified amount within the agreed-upon timeframe and upon presentation of the specified documents.

The party applying for a letter of credit (LC) is the importer, while the recipient is the exporter, who is considered the beneficiary. Within the LC, the issuing bank pledges to make the payment for the specified amount in accordance with the agreed-upon schedule and upon presentation of the specified documents.

An essential principle of a letter of credit (LC) is that the issuing bank's payment obligation relies solely on the conformity of the presented documents and does not involve verifying the physical shipment of goods. As long as the presented documents align with the terms and conditions of the LC, the bank has no grounds to refuse payment.

Securing Global Transactions: The Vital Role of Letters of Credit

A letter of credit offers advantages to both parties involved in a trade agreement. It provides assurance to the seller that they will receive payment upon meeting the terms of the agreement, while enabling the buyer to demonstrate creditworthiness and negotiate extended payment terms, with the support of a bank backing the transaction.

Building Trust in International Trade: The Distinctive Characteristics of Letters of Credit

The principles governing a letter of credit are consistent across all types of such documents. The primary features of letters of credit can be outlined as follows:

Negotiability

A letter of credit represents a transactional agreement, wherein the terms may be altered or adjusted with the agreement of the involved parties. To possess negotiability, a letter of credit must incorporate an unequivocal commitment to payment upon request or at a specified future date.

Revocability

A letter of credit can be classified as either revocable or irrevocable. A revocable letter of credit lacks the option for confirmation, allowing the obligation to pay to be rescinded at any given moment. Conversely, an irrevocable letter of credit empowers all parties involved and cannot be altered or amended without the unanimous consent of the designated individuals.

Transfer and Assignment

A letter of credit possesses the capacity for transferability, enabling the beneficiary to exercise the right to transfer or assign it. Regardless of the number of times the beneficiary assigns or transfers the letter of credit, its effectiveness and validity persist without any compromise.

Sight & Time Drafts

The beneficiary will receive payment from the issuing bank only upon the maturity of the letter of credit, provided that they present all the required drafts and necessary documents.

The Key to Successful Letters of Credit: Must-Have Document Checklist

Shipping Bill of Lading

Airway Bill

Commercial Invoice

Insurance Certificate

Certificate of Origin

Packing List

Certificate of Inspection

Unlocking Trade Potential: A Closer Look at How Letters of Credit Works

A letter of credit (LC) establishes an arrangement wherein the issuing bank has the authority to act based on the instructions and requests of either the applicant (importer) or on its own behalf. Within the framework of an LC, the issuing bank has the capability to make payments to the beneficiary (exporter) directly or as per their instructions. Alternatively, the issuing bank may accept bills of exchange or drafts drawn by the exporter. Additionally, the issuing bank has the power to authorize advising or nominated banks to make payments or accept bills of exchange.

Decoding LC Costs: Understanding the Fees and Charges Involved

When dealing with a letter of credit (LC), there exist multiple fees and reimbursements that come into play. Typically, the responsibility for managing the payment process under the LC is shared among all involved parties. The fees charged by banks may include:

- The charges incurred at the outset of opening an LC, which encompass upfront commitment fees, and the usance fee applicable for the agreed duration of the LC.

- At the conclusion of the LC period, retirement charges become payable. These charges encompass an advising fee levied by the advising bank, reimbursements owed by the applicant to the bank for foreign law-related obligations, the fee charged by the confirming bank, and bank charges payable to the issuing bank.

Navigating the Network: Unravelling the Parties Involved in an LC

- Applicant An applicant (buyer) is a person who requests his bank to issue a letter of credit.

- Beneficiary A beneficiary is basically the seller who receives his payment under the process.

- Issuing bank, the issuing bank (also called an opening bank) is responsible for issuing the letter of credit at the request of the buyer.

- Advising bank, the advising bank is responsible for the transfer of documents to the issuing bank on behalf of the exporter and is generally located in the country of the exporter.

Other parties involved in an LC arrangement:

- Confirming bank, the confirming bank offers an additional level of guarantee for the commitments made by the issuing bank. It becomes involved when the exporter requires additional assurance beyond what the issuing bank provides.

- Negotiating bank, the negotiating bank handles the negotiation of documents pertaining to the LC that are submitted by the exporter. It disburses payments to the exporter, contingent upon the documents' completeness, and seeks reimbursement under the credit. It's important to note that the negotiating bank can function as a distinct entity or serve as the advising bank as well. Reimbursing bank the reimbursing bank is where the paying account is set up by the issuing bank. The reimbursing bank honours the claim that settles the negotiation/acceptance/payment coming in through the negotiating bank.

- Second Beneficiary The second beneficiary is authorized to act as a representative of the original beneficiary in case of their absence. In such a situation, the exporter's credit is transferred to the second beneficiary, adhering to the specified terms of the transfer.

Smooth Operations: Essential Steps for a Successful Letter of Credit Process

Step 1 - Issuance of LC

Once the trade parties reach an agreement on the contract and the utilization of an LC, the importer submits an application to the issuing bank for the issuance of the LC in Favor of the exporter. The issuing bank then transmits the LC to the advising bank, which is typically located in the exporter's country and may even be the exporter's own bank. The advising bank, acting as the confirming bank, validates the authenticity of the LC and subsequently forwards it to the exporter.

Step 2 - Shipping of goods

Upon receiving the LC, it is the exporter's responsibility to thoroughly review and confirm its accuracy and terms. Once satisfied, the exporter proceeds with initiating the shipment of goods.

Step 3 - Providing Documents to the confirming bank

Once the goods are shipped, the exporter, either directly or through freight forwarders, submits the required documents to the advising/confirming bank.

Step 4 - Settlement of payment from importer and possession of goods

Subsequently, the bank forwards the documents to the issuing bank, and the payment, acceptance, or negotiation process takes place based on the specific circumstances. The issuing bank thoroughly examines the presented documents and collects payment from the importer accordingly. Once the payment is received, the issuing bank dispatches the documents to the importer, enabling them to take possession of the shipped goods.

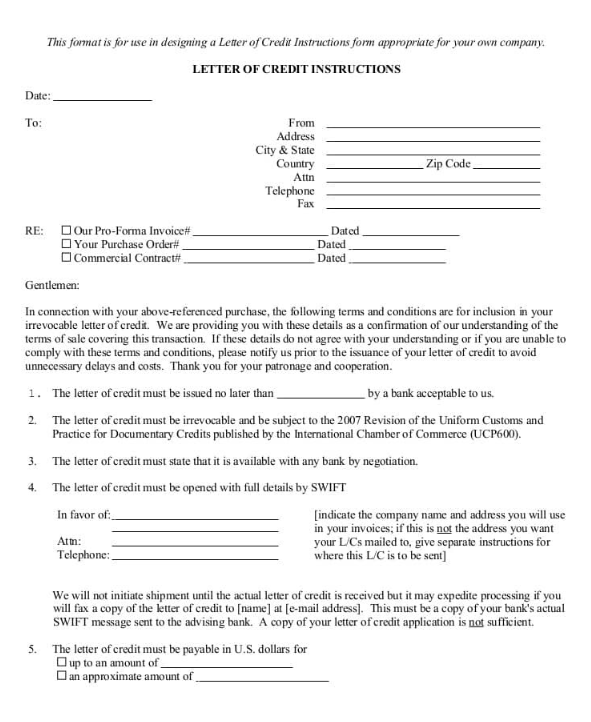

.png)

Letter of credit Sample Format

Exploring the Diverse Types of Letters of Credit: Your Ultimate Guide

Following are the most commonly used or known types of letters of credit: -

- Revocable Letter of Credit

- Irrevocable Letter of Credit

- Confirmed Letter of Credit

- Unconfirmed Letter of Credit

- LC at Sight

- Usance LC or Deferred Payment LC

- Back-to-Back LC

- Transferable Letter of Credit

- Un-transferable Letter of Credit

- Standby Letter of Credit

- Freely Negotiable Letter of Credit

- Revolving Letter of Credit

- Red Clause LC

- Green Clause LC

Image by vector4stockImage on Freepik

Unleash the Power of LC: Mastering the Application Process for International Transactions

Importers must adhere to a specific procedure when applying for Letters of Credit (LCs). The step-by-step process is outlined below:

- The importer's bank, known as the issuing bank, generates a comprehensive LC that mirrors the terms and conditions outlined in the sales agreement. This LC is then transmitted to the exporter's bank.

- In the next step, the exporter and their bank evaluate the creditworthiness of the issuing bank. Once they are satisfied with the assessment and have verified the LC, the exporter's bank grants approval and forwards the document to the importer.

- Upon receiving the LC, the exporter commences the production of goods and arranges for their shipment within the agreed-upon timeframe. A shipping line or freight forwarder is engaged to facilitate the smooth delivery of the goods.

- Simultaneously, the exporter prepares and submits the required documents to their bank, ensuring compliance with the terms specified in the sales agreement.

- Upon careful review and verification, the exporter's bank sends the compliant documents to the issuing bank.

- Subsequently, the issuing bank scrutinizes the documents to ensure they meet the prescribed requirements. Once the review is complete, the issuing bank initiates the payment process, releasing the funds to the exporter. At the same time, the issuing bank dispatches the approved documents to the importer, enabling them to take possession of the shipped goods.

Secure Your Trade: How an LC Safeguards Payments in Global Transactions

Both the seller and the buyer benefit from a letter of credit, as it provides assurance to the seller that they will receive payment once they meet the conditions of the trade agreement. Simultaneously, the buyer can establish their creditworthiness and negotiate more extended payment terms by involving a bank to support the trade transaction.

Both importers and exporters derive numerous advantages from utilizing letters of credit. Importers benefit primarily by maintaining control over their cash flow, as they can avoid prepaying for goods. Conversely, exporters enjoy significant advantages such as mitigating manufacturing and credit risks. It is important to consider various factors such as the location, distance, and laws/regulations of the countries involved, as these factors frequently come into play in international trade deals.

Detailed below are the in-depth explanations of the advantages associated with a letter of credit:

1.LC reduces the risk of late-paying or non-paying importers

There are instances where the importer alters or cancels their order while the exporter has already produced and shipped the goods. It is also possible for the importer to reject payment for delivered shipments, citing issues or grievances with the goods. In these scenarios, a letter of credit ensures that the exporter or seller of the goods receives payment from the issuing bank. Moreover, this document acts as a safeguard in the event that the importer becomes bankrupt.

2. LC helps importers prove their creditworthiness

Small and midsize businesses face constraints in capital reserves when it comes to managing payments for vital supplies such as raw materials and equipment. In situations where these businesses have contractual commitments to manufacture and deliver products within limited

timeframes, they cannot afford to wait for capital to become accessible for procuring the necessary supplies. This is precisely where letters of credit come to their aid. By facilitating important purchases, a letter of credit acts as proof to the exporter that the business will fulfil its payment responsibilities, thereby preventing any potential transactional or manufacturing delays.

3. LCs help exporters with managing their cash flow more efficiently

Apart from its various advantages, a letter of credit plays a vital role in ensuring timely payment for exporters or sellers. This becomes particularly significant when there is a considerable time lag between the delivery of goods and the actual receipt of payment. By guaranteeing punctual payments through the letter of credit, exporters can effectively handle their cash flow. Additionally, sellers have the opportunity to secure financing during the period between shipping the goods and receiving payment, thereby obtaining an extra infusion of cash in the short term.

Smart Trade Moves: Preparing for an LC - What You Must Consider

Exporters must consistently remember the importance of submitting documents in full compliance with the terms and conditions stipulated in the LC. Failure to adhere strictly to the LC requirements can result in non-payment, payment delays, and disputes.

It is crucial that the issuing bank possesses a strong and reputable standing, along with the necessary financial stability to honour the LC when the need arises.

Before opting for an LC, it is essential to clarify the allocation of cost responsibilities. Assigning costs to the exporter can result in increased recovery expenses. Additionally, it is important to consider that the cost of an LC is typically higher compared to other export payment methods. Therefore, apart from determining cost allocation, it is crucial to assess the cost-benefit aspect of an LC in comparison to alternative options.

If you have any inquiries about the most suitable type of LC for your import-export business in Bangladesh, please do not hesitate to reach out to us.

Recent Blogs

COMPRESSOR SPARE PARTS AND OIL PRICE LIST

GENERAL PUMPS PRICE LIST

Navigating International Trade with Letter of Credit (LC): The Key to Smooth Transactions

Maximize Profits and Minimize Costs: A Guide to Winning Supplier Negotiations